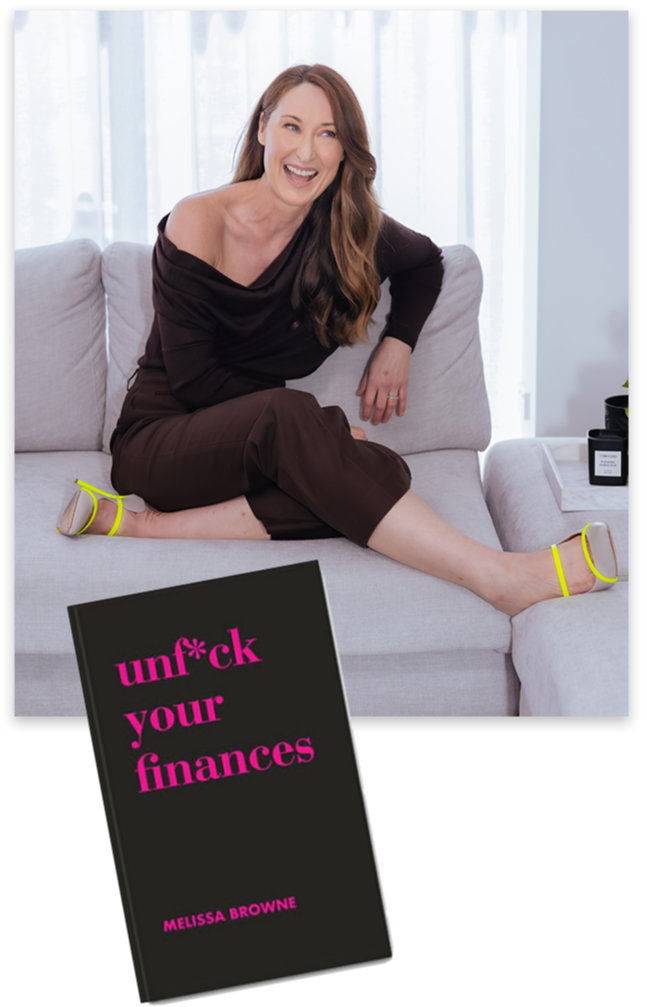

Hey, I’m Mel.

I'm an ex-financial advisor & ex-accountant who ran my own successful accounting business for almost 20 years before selling six months before Covid hit. I've also written 4 books about business and money including the global bestseller, Unf*ck your Finances. My fifth book, Dare to be Wealthy will be released in February 2026.

So I have theory to be a financial educator. But I also have the life experience.

I'm a Western Sydney chick who grew up in a household where we didn't talk about money, and didn't have a whole lot of it either. I wore cousin's hand-me-downs and going to McDonalds was a fancy meal out.

But it was as an adult that I made my biggest money mistakes. From credit and store cards to coming back from less than nothing in my early thirties after I gave all of my divorce proceeds (and every cent in my business and personal account to charity). A move I instantly regretted. That decision meant I needed to move into a shared house with 4 mates and go into 5 figures of debt. To say I was ashamed was an understatement. That experience means I know what it feels to not be at an age and stage that you thought you should be.

Today, I'm financially independent and have choice but it meant I needed to learn how to do money better, to learn how to build my income, understand why I behave the way I do with money and learn how to invest.

What else do you need to know? I'm socially awkward, super introverted and a serial overdresser. Oh and I hate crocs with a passion.

Hey, I’m Lauren Law

AKA Lawsie!

I'm Mel's 2IC and have worked with her for almost 16 years!

A little bit about me? I'm the proud mum of a cocker spaniel and a big fan of the simple pleasures in life (like kicking back in my comfiest jeans and flats and weekends away camping)!

I’m *also* an ex-accountant and ex-financial advisor who cracked the money management puzzle in my 30s.

By tapping into the power of a personalised financial plan, I’ve been able to:

✨ Set crystal clear financial goals and identify how much is “enough.”

✨ Build up financial assets that’ll fund *my* version of financial independence.

✨ Develop financial habits that allow me to enjoy life’s pleasures today while still saving money for future me!

The result?

In my 40s, I too will be financially independent, with the choice to travel, to work or clock out for an early retirement!

Keen to educate yourself about money?

Hop on the waitlist for the next round of the My Financial Adulting Plan!

Simply pop your details below and you'll be the first to know when we open our doors AND get access to a special Waitlist bonus.

General Financial Advice Warning

Mel Browne Money Pty Ltd (ABN: 75 143 850 864) is a Corporate Authorised Representative No. 1316933 of Rask Licensing Pty Ltd (ABN: 32 681 073 478) (AFSL: 563 907).

The information, tools and content on this website is general financial advice only. That means, the advice/information from Mel Browne Money and its staff does not take into account your objectives, financial situation or needs. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. In addition, you should obtain and read the product disclosure statement (PDS) and Target Market Determination (TMD) before making a decision to acquire any financial product. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. Please read our Terms and Financial Services Guide before using this website. Past performance is not indicative of future performance, and investing can result in permanent capital loss.