The Budget without the BS

Mar 31, 2022

Every year I write a 'Budget without the BS'. It's the highlights of the budget and what they mean for YOU but without the political spin or media clickbait.

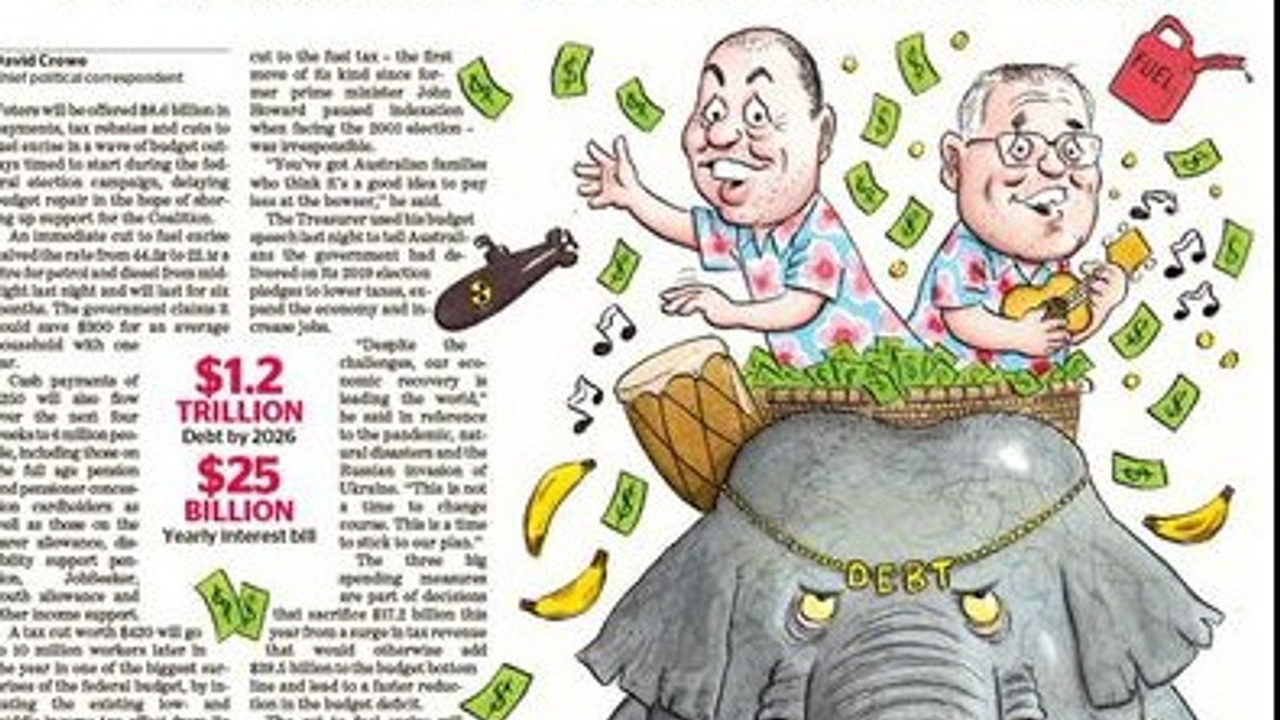

Let's start with my thoughts on the budget (which an be summarised by the front page of the SMH shown above). It's VERY clear this is an election budget - it's a budget aimed squarely at buying winning votes. The government seem to have forgotten we have a huge deficit thanks to covid stimulus spending and have kicked that repair job down the road to future generations. If I was a young person I'd be so mad at their flippancy and the debt burden they're deferring to them. And the spending? Honestly, it feels like they're popping a bandaid on a gaping wound. I mean, giving a tax cut of up to $420 for one year which let's be honest, will do nothing but exacerbate short term term inflationary pressures. It's a distraction technique - get you excited about the short term candy they're handing out, all the while hoping you'll ignore what's really going on.

But, with that rant over, what does the budget mean to your bank account? I've split up the spending into different groups so you can see what is relevant and overlook what isn't.

Cost of Living Offsets

- $420 extra for up to 10 million households: The low and middle-income tax offset will rise from $1080 to $1500 for this year only (Pro-rata depending on your income for Australians earning less than $126k a year). This offset will disappear completely from next year.

- $250 payment: If you're on a government payment you could be eligible for a one-off 'cost of living payment' worth $250. It will automatically paid in April to up to 6 million Australians including those on the age pension, disability support pension, parenting payment, carer payment, jobseeker, youth allowance, austudy & abstudy and more.

- Fuel excise cut by 50% for 6 months: You currently pay excise worth 44.2c on every litre of petrol or diesel you buy - this change will cut that to 22.1c for 6 months after budget night. According tot the government, a family with 2 cars who fill up once a week could save approx $30 per week

Families with children

- Paid parental leave will become more flexible: The current Dad and Partner Pay will be integrated into the Parental Leave Pay creating a single scheme of up to 20 weeks (rather than 2 separate schemes of 18 & 2 weeks). This will be fully flexible & shareable for parents as they see fit within 2 years of their child's birth or adoption. The income test will also be broadened - if you don't meet the individual income threshold of $151,350 you can still qualify if you meet a family income threshold of $350k per annum. Single parents will also have their leave extended to 20 weeks.

- $1.5 billion to prevent violence against women and children

Home Buying

- The Home Guarantee Scheme will be expanded to 50,000 places per year: This scheme allows first home buyers to build or purchase a newly built home with a low deposit (between 2 and 5%), without the need for Lenders' Mortgage Insurance. 35,000 guarantees from 1/7/22 for First Home Buyers, 10,00 guarantees from 1/10/22 for regional homes & 5,000 guarantees for single parents with dependants. Application for the various Home Guarantee Schemes is made through participating lenders.

Business

- Apprentices in industries with skills shortages will receive up to $5,000 cash: While wage subsidies will be scaled back for employers. The cynic in me wonders how once again the construction industry has benefited from this while female-heavy industries who are facing huge shortages such as childcare aren't receiving anything, but I digress.

- Small business can claim a $120 tax deduction for every $100 spent on training staff or investing in digital services: For a value of up to $100,000. Digital spending includes upgrades to cybersecurity systems, websites, cloud computing, portable payment devices or online sales platforms. While the word 'small' is used, I don't believe businesses captured here are necessarily small as it's available to businesses with a turnover of less than $50 million.

What's missing and who is losing?

- Climate change: After committing to net zero emissions by 2050, there is no word or promises in this budget as to how we're going to make that target. No mention of climate change or any other renewable measures.

- Future generations are the clear losers. Net debt will reach 31.1% of GDP by June 2023 (or $714.9 billion) and it's still growing. It's expected to peak at 33.1% y 2025 before beginning to decline.